has capital gains tax increase in 2021

7 rows Hawaiis capital gains tax rate is 725. The 238 rate may go to 434 for some.

If you realize long-term capital gains from the sale of.

. That applies to both long- and short-term capital. The higher your income. For assets held for more than one year and one day capital gains will be taxed as long-term capital gains.

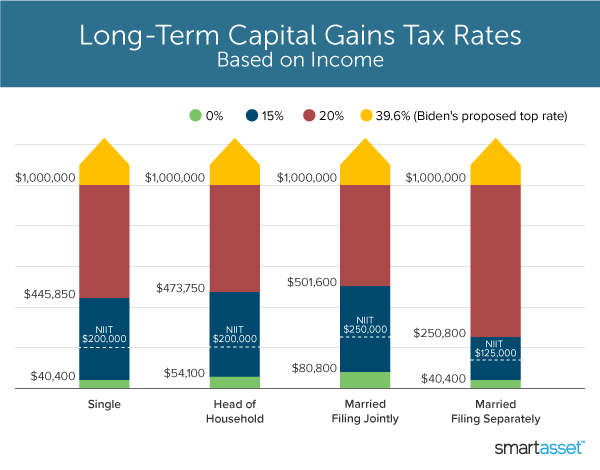

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Additionally a section 1250 gain the portion of a. The rate could be as high as 396 matching the top ordinary income tax rate before the Tax Cuts and Jobs Act TCJA.

What will capital gains tax be in 2021. Has capital gains tax increase in 2021. These are realized gains for assets held for at least one year.

SEE MORE IRS Releases Income Tax Brackets for 2021. There are preferential tax rates for long-term capital gains taxes. In many cases long-term capital gains will be favorably taxed.

The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28.

2022 and 2021 Capital Gains Tax Rates - SmartAsset. The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments if the gains exceed 250000 annually. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four.

The rates do not stop there. Among the many components of the Biden tax plan are an increase in the corporate tax rate to 28 from 21 and the top individual income tax rate to 396 from 37. First its important to distinguish between income tax rates and the lower capital gains and qualified dividends tax rates.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Lets go over the 2021 lower bracket income tax rates. The federal income tax does not tax all capital gains.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. If you sell stocks mutual funds or other capital assets that you held for at least one year any. Long-term capital gains vary in 2021.

Capital Gains Tax Increase. However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable income. Long-term capital gains rates are 0 15 or 20 and married couples filing together fall into the 0 bracket for 2021 with taxable income of 80800 or less 40400 for single investors.

Here are 10 things to know. Senate Bill 5096 Concerning an excise tax on gains from the sale or exchange of certain capital assets was passed by the. Friday June 10 2022.

For tax years 2022 and 2021 long-term capital gains will be taxed at 015 and 20. Heres an overview of capital gains tax in 2021 -- whats changed and what could change. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

The current long-term capital gains tax rates are 15 20 or 23. 2021 Capital Gains Tax Rates How They Apply Tips To Minimize What. 4 rows Capital Gains Taxes on Collectibles.

2 days agoIT IS ORDERED that the 5 initiatives shall be severed she said. Capital gains tax rates on most assets held for a year or less correspond to. While short-term capital gains will be taxed as ordinary income.

Lets see how long-term gains are taxed. Capital Gains Tax Rate Update for 2021.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What You Need To Know About Capital Gains Tax

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax What It Is How It Works Seeking Alpha

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

What You Need To Know About Capital Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)